Financial services advises students receiving loans

November 6, 2014

As years pass, the cost of tuition only increases, forcing a large amount of students to take out loans this semester, and doing so could be detrimental to finances if they do not practice responsible borrowing.

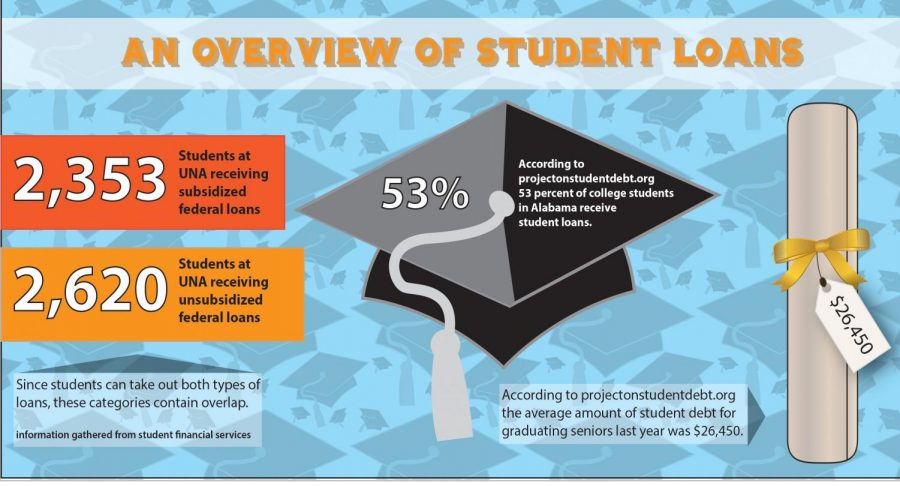

There are 2,353 UNA students receiving subsidized federal loans, meaning all interest is absorbed until the student graduates, said Ben Baker, director of student financial services. 2,620 students are receiving unsubsidized loans, meaning they accumulate interest at the start of the term.

Since students can take out both types of loans, the categories may have overlap.

Baker said he estimates 3,800 students receive federal loans this semester.

Sophomore Dominique White said she receives both a federal loan and a private loan.

“I didn’t have a choice but to take out loans,” she said. “The decision was pretty much made for me because if I wanted to come to school, I couldn’t do it without a loan. I couldn’t pay for it out of pocket, and my parents make too much for me to qualify for the Pell Grant. “

Pell Grants are given to low-income undergraduate students.

When taking out loans, it is important for students to only borrow as much as they need, for housing, tuition, meals, transportation and other necessities, Baker said.

“I think there are students here at UNA that will borrow money for items they want instead of items they need,” he said. “Project what your cost is going to be for the year, look at the money you have to go toward your cost and borrow responsibly.”

Sophomore scholarship recipient Kelly Melton, said she thinks students should apply for as many scholarships as possible.

“You really have to look, but there are a lot of scholarships out there,” she said. “There are some bizarre ones, like scholarships based on height or if the student is one-sixteenth Cherokee. There are also minority scholarships.”

Baker said students should consider whether or not their future job will allow them to pay back loans, even though it can be difficult to gauge.

Because the maximum loan limit is $31,000 for dependent students, they should plan out how much they can borrow per semester, he said.

“If all you ever did was take 12 hours per semester, which is 24 hours per year, it’s going to take you five years to graduate,” Baker said. “That’s assuming you pass every course, don’t change your major and every class goes toward your degree. If you were taking out student loan money every year, you’re probably going to run out of loan money before you get those 10 semesters done.”

Full-time students should not work more than 20 hours a week, he said.

“From our experience here in the (financial services) office, the students who work a greater number of hours are likely to have academic trouble,” he said. “There are some students that may be married with children, may be single parents or may have dependents. It would be better for that student to be a part-time student, maybe taking one to two courses a semester.”

Junior Wesley Daniels said he previously took out a loan but has already paid it back.

“If you do have to take out a loan, try to find any type of job to start paying back on it,” he said. “The more you wait, the more the interest gains, depending on what type of loan you have. I had two jobs to pay off my loan.”