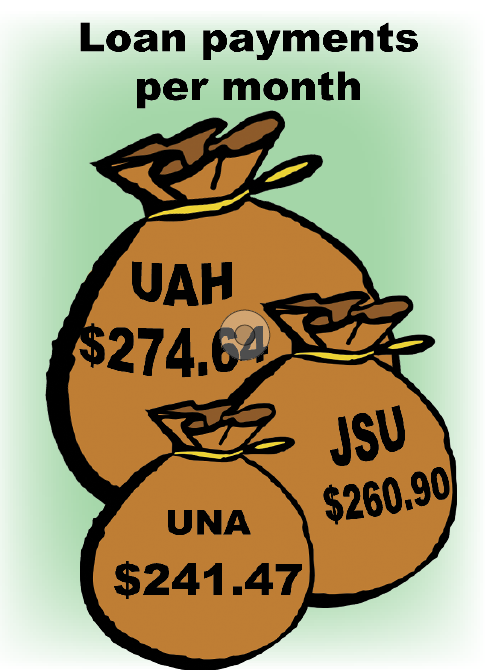

UNA students pay lower loan payments

November 15, 2015

With nearly 75 percent of college students using loans to pay for school, more and more students fail to repay their loans after graduation. However, UNA students who receive federal loans owe less after graduation.

When comparing UNA to Jacksonville State University and the University of Alabama in Huntsville, statistics show UNA Pell Grant students paid less than both of those schools.

“It is expensive, but when you start comparing (UNA) to other institutions, I don’t believe (tuition rates) are completely out of line,” said Director of Student Financial Services Shauna James. “I think we are very reasonably priced.”

UNA had the most affordable tuition rates compared to UAH and Jacksonville State, which are comparable in enrollment. Also, UNA’s Pell Grant students, on average, pay less per year than at both universities. However, many UNA students must borrow money to pay for school, James said.

“Even the full Pell Grant that students receive is not enough to pay for tuition and fees,” James said. “Unless the student has money from a parent, relative or somewhere else, they’re going to have to borrow. If you have a full Pell and a scholarship, you might can get by without borrowing (at UNA), but there’s a large number of students here and at any four-year institution that do have to end up borrowing.”

About 70 percent of UNA students used loans to pay tuition in 2013, according to a report from propublica.org.

Senior Morgan Hastings said the thought of having to pay back loans right after graduation is intimidating.

“It’s a whole lot of money due that hits right after graduation,” she said.

UNA alumna Rebecca Poe said she feared she wouldn’t have a job before the six-month loan repayment grace period ended.

“The payments are certainly burdensome, especially now with a mortgage and a child in daycare,” Poe said. “(Recent graduates should) pay loan payments even before the grace period is over to lessen the interest. It’s not the loans, but the interest that will get you. It adds up quickly.”

When students do not repay their loans, not only are those students hurt, but the university could suffer as well.

The U.S. Department of Education uses a 3-year default rate to measure the percentage of students from each university who default on their loans.

“As long as the default rates do not get above 30 percent, then we’re OK,” James said. “Once you get to the 30 percent and above mark, that’s when the university can be penalized.”

UNA’s current default rate is 11.1 percent of students, according to a report from the National Student Loan Database released October 2015.

More than 31 percent of UNA students who have been out of school for three years have not been able to pay back $1 of their student loans, according to a report from propublica.org. Also, over 37 percent of Pell Grant recipients who have been out of school for three years have not been able to pay back $1 of their student loans.

James said graduates should contact their loan servicer if they cannot afford their loans for any reason. Failure to pay back loans could send the loan into default, which impacts the student’s credit score, she said.

“Anything can happen in life,” she said. “I don’t advise them to just not make payments because they don’t have the money.”

![Caleb Crumpton [COURTESY OF UNA SGA]](https://theflorala.com/wp-content/uploads/2024/07/caleb-crumpton-courtesy-of-SGA-425x600.jpg)